Being a millionaire is just another small powerless voice in the land of the financial elite and powerful. Of Course they’d support a qualified change of a 2% tax for those over $10M in investments to help the trickle-down that never occurred these past 50-plus years. Only too happy to salvage a dying system rather than change it. It’s a bit of a cry by millionaires to ” Hey look over there” Billionaires and Trillionaires they need to give a lot more”. Millionaires already saw their taxes generously reduced and profits up by far more than 2% aren’t giving back anything they made in real terms.

It’s the structure of global corporations that needs to be changed from private to public and a real Future Fund established and they need to be taxed and the profits invested for our and a global common good. Can you imagine the Military Industrial Complex battling the war on poverty health and housing? Their shareholders need to feel the benefits of profit sharing and not feel it as a punishment tax simply because of their current lack of interest in contributing to a common good. Israel and its supporters currently need to be heavily punished and taxed. The Bhutanese on the other hand don’t as they already base their economy on ” Gross National Happiness”

A recent survey has found that nearly half of all millionaires from G20 countries think extreme wealth is a threat to democracy.

The survey was conducted by Survation on behalf of Patriotic Millionaires and found that three-quarters of those questioned supported higher taxes on wealth.

For the survey more than 2300 people from G20 countries with more than $1 million investable assets, excluding their homes, were polled.

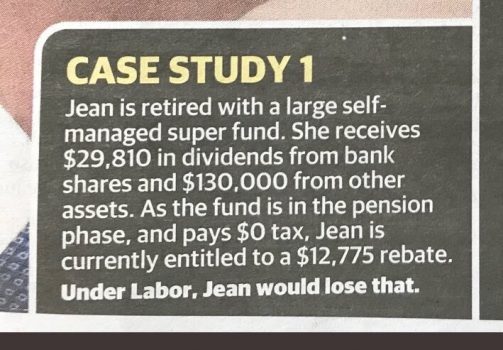

The survey found 74 per cent were in support of higher taxes on wealth to aid the cost-of-living crisis and improve public services.

Some 75 per cent also support a two per cent wealth tax on billionaires being introduced, and 58 per cent support the tax for people with more than $10 million.

Additionally, 72 per cent believe extreme wealth can buy political influence and 54 per cent maintain that extreme wealth is a threat to democracy.

You must be logged in to post a comment.