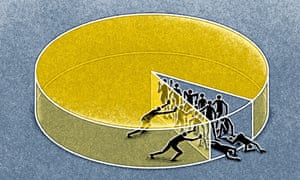

It’s clear George Osborne intends to make austerity permanent. Those at the top will benefit, but hard times beckon for everyone else

Category: Economy

One of Australia’s most respected public policy think-tanks says ‘negative gearing’ does not benefit everyday Australians in the way its proponents suggest.

Source: Negative gearing benefits the rich far more than everyday Australians, analysis shows

Scott Morrison says Australia relies more on income tax than all other OECD countries except Denmark. Is this correct? ABC Fact Check investigates.

Ever wondered how much is spent annually to feed the poor ‘lazy’ Americans? Three main programs needy families depend upon — Temporary Assistance for Needy Families ($17.3 billion), Food Stamps ($74 billion), and Earned Income Tax Credit ($67.2 billion) — cost $158.5 billion a year. …

Source: Who Is Robbing America? The 1%. And The 99% Don’t Even Know. AnonHQ

A predicted global meltdown passed without event. But there are enough warning signs to suggest we are sleepwalking into another disaster

Source: Apocalypse now: has the next giant financial crash already begun? | Comment is free | The Guardian

What really should be Australia’s ambitions for its military?

Source: Does Australia’s military need such tentacles of defence?

Turns out throwing white-collar criminals in jail doesn’t kill your economy.

Source: Iceland, Where Bankers Actually Go To Jail For Committing White-Collar Crimes | ThinkProgress

“Few ideas have more profoundly poisoned the minds of more people,” argues the former secretary of labor

Source: Robert Reich: There’s no such thing as a “free market” – Salon.com

When you scrape below the surface it’s not hard to see that ‘culture’ is the wrong answer to almost every question.

Source: Why are we blaming ‘culture’ for social and economic problems?

Technically, Australia isn’t in recession; but data shows we are effectively in a situation of negative growth.

Source: Data indicates the recession is effectively here; it’s what policy makers do next that counts

Is there a causal link between how a government treats refugees and how many jobs are created in the economy?

The latest figures on the health of the Australian economy as shown in the June 2015 quarter National Accounts continues to paint a gloomy picture. Meanwhile, the spin that Treasurer Joe Hockey and Finance Minister Mathias Cormann offer, is priceless. It seems the thrust of their argument is that it doesn’t matter how bad the…

The latest figures on the health of the Australian economy as shown in the June 2015 quarter National Accounts continues to paint a gloomy picture. Meanwhile, the spin that Treasurer Joe Hockey and Finance Minister Mathias Cormann offer, is priceless. It seems the thrust of their argument is that it doesn’t matter how bad the…

Source: Economy Heading South. No One at the Helm. – » The Australian Independent Media Network

Quarterly growth figure is half the expected rate, dragged down by reduced mining and construction activity and export woes

Quarterly growth figure is half the expected rate, dragged down by reduced mining and construction activity and export woes

Source: Jitters as Australian economy grows by just 0.2% in June quarter | Business | The Guardian

Research reveals a huge proportion of Australia’s richest people amass their wealth via political connections rather than via innovative businesses – which is helping them at the expense of everyone else.

Research reveals a huge proportion of Australia’s richest people amass their wealth via political connections rather than via innovative businesses – which is helping them at the expense of everyone else.

Source: Battlers and plutocrats: How political connections reward Australia’s super-rich

The Truth is very, very slowly becoming clearer and clearer about the China FTA. It’s now been revealed that there are a number of side letters that were exchanged between the countries.

In one, the Abbott Government has sold out the jobs of tradies to the Chinese. Under the agreement there will be NO requirement for Chinese workers who come into Australia to have the necessary trade qualifications or accreditation that Australian workers have. So much for “Tony’s Tradies”.

100,000 more people have joined the jobs queue since Tony Abbott was elected and Australia’s unemployment rate has now had a six in front of it for over a year.

Under Tony Abbott and Joe Hockey’s Liberals we have the most people unemployed since 1994, and their only plan is to bring back WorkChoices.

EARLIER this month, when the billionaire merchandising mogul Johann Rupert gave a speech at The Financial Times’s “luxury summit” in Monaco, he sounded more like a Marxist theoretician than someone who made his fortune selling Cartier diamonds and Montblanc pens. Appearing before a crowd of executives from Fendi and Ferrari, Mr. Rupert argued that it wasn’t right — or even good business — for “the 0.1 percent of the 0.1 percent” to raid the world’s spoils. “It’s unfair and it is not sustainable,” he said.

For several years now, populist politicians and liberal intellectuals have been inveighing against income inequality, an issue that is gaining traction among the broader body politic, as shown by a recent New York Times/CBS News poll that found that nearly 60 percent of American voters want their government to do more to reduce the gap between the rich and the poor. But in the last several months, this topic has been taken up by a different and unlikely group of advocates: a small but vocal band of billionaires.

In March, for instance, Paul Tudor Jones II, the private equity investor, gave a TED talk in which he proclaimed that the divide between the top 1 percent in the United States and the remainder of the country “cannot and will not persist.” Mr. Jones, who is thought to be worth nearly $5 billion, added that such divides have historically been resolved in one of three ways: taxes, wars or revolution.

A few months earlier, Jeff Greene, a billionaire real estate entrepreneur, suggested on CNBC that the superrich should pay higher taxes in order to restore what he called “the inclusive economy that I grew up in.”

And in June, Nick Hanauer, a tech billionaire from Seattle, wrote a blog post laying out the capitalist’s case for a $15 minimum wage. The post echoed sentiments that Mr. Hanauer made in a separate polemic he wrote last summer for Politico, in which he addressed himself directly to the planet’s “zillionaires” and said: “I have a message for my fellow filthy rich, for all of us who live in our gated bubble worlds: Wake up, people. It won’t last.”

What’s going on here? Are all these anxious magnates really interested in leveling the playing field or are they simply paying lip service to a shift in the political winds? Or perhaps it’s just a statistical blip, given that most of the world’s 1,800 billionaires are not exactly out at the barricades lifting pitchforks for economic change.

According to Chrystia Freeland, author of the 2012 book “Plutocrats: The Rise of the New Global Super Rich and the Fall of Everyone Else,” the phenomenon of the socially conscious billionaire is significant and good. “It is absolutely happening,” Ms. Freeland said. “After my book came out, a few billionaires quietly got in touch with me to say that they agreed that the current system isn’t working. It makes sense that the people who have benefited most from the economy have the greatest interest in making it sustainable.”

Ms. Freeland, who is also a Liberal Party member of the Canadian Parliament, pointed to the so-called Conference on Inclusive Capitalism, organized in London last year by Lynn Forester de Rothschild, a member of the storied Rothschild banking clan. While the one-day event was derided by some as a nervous hedge against the threat of insurrection, the ostensible purpose of the gathering was to reorient the 1 percent toward public-minded goods like long-term investing, environmental stewardship and the fate of the global working class.

Financiers like George Soros and Warren E. Buffett have trod this ground before to great attention, but now that other billionaires have been moved to join them, it has helped to change the conversation, said Darrell M. West, a scholar at the Brookings Institution and the author of “Billionaires: Reflections on the Upper Crust.”

“The messenger matters,” Mr. West said. “When people of modest means complain about inequality, it usually gets written off as class warfare, but when billionaires complain, the problem is redefined” — in a helpful way, he added — “as basic fairness and economic sustainability.”

This is not to say that the current crop of concerned tycoons is working purely out of altruistic motives. “There’s been a major backlash against inequality,” Mr. West said. “And some wealthy individuals have felt a pressure to address it.”

Given the political groundswell for decreasing wealth disparity, Mr. West added, “There’s a realization among the billionaire class that it’s actually in their own self-interest to at least spread some of the wealth around.”

Of course, it may be that some of these outspoken billionaires are not responding to politics so much as playing it themselves. “I’m not surprised to hear the wealthy saying these things, but talk is cheap,” said Dennis Kelleher, the president of Better Markets, which advocates financial reform. “These people know exactly how to move the levers of power and, until that happens, whatever they say is nothing but empty words.”

According to William D. Cohan, a former Wall Street banker who has written frequently about billionaires, if the investor class were truly interested in targeting unfairness, its members would try to alter the policies of the Federal Reserve, which tend to help the rich, or do away with inequity-inducing programs like tax incentives for hedge funds.

Mr. Cohan said that proposals like increasing the minimum wage, a popular rallying cry among those decrying income inequality, would have, at best, a minimal effect on reducing the rift between ordinary people and the 1 percent.

Most billionaires, he added, are apt to address inequality by donating portions of their fortunes, not by seeking systemic economic change. “Charity? Yes,” Mr. Cohan said. “But leveling the playing field? No.”

And yet the extremely wealthy do face an abiding risk from festering inequity: The have-nots might finally lose patience and turn upon the haves.

“That’s the real danger,” Mr. Cohan said. “This little thing called the French Revolution.”

The end of the financial year equals snout in the trough time for society’s self-proclaimed lifters. Stuart Rollo explains.

As June becomes July, and winter proper sets in, millions of Australia’s higher income earners will find great warmth in the prospect of their substantial tax returns waiting to be filed. They have spent the past months absorbing the tax avoidance advice which has bombarded them from all directions, and now they’re champing at the bit to reap the returns to which they are so richly due.

The end of financial year is the annual zenith of Australia’s ongoing middle and upper-class age of entitlement.

The season’s greeting could come in the form of PR posing as journalism from a business like OfficeWorks (AKA ‘Your Happy Tax Place’), encouraging across the board expensing.

It could come from that one colleague, summoned from the woodwork by the smell of fresh group certificates, who unsolicitedly advises on how best to claim expenses on your car, or at which point you should limit your tax deduction claims to avoid unwanted scrutiny, (“it will cost the government X amount to look into your case so if your refund is smaller than that then it won’t be worth it for them anyway”).

But no matter how it comes, the message is clear; do whatever you can to keep as much money in your (or your accountant’s) own pocket, and out of the government’s grasping paws.

The national mania for personal tax avoidance is bipartisan. It is an attitude most famously vocalised by Kerry Packer, when, in response to the accusation of tax minimisation ‘contrary to the spirit of the law’, he told the Federal Government’s inquiry into the print media; “Of course I am minimising my tax, and if anybody in this country doesn’t minimise their tax they want their heads read, because, as a government, I can tell you, you’re not spending it that well that we should be donating extra”.

A sentiment endemic to the Australian middle and upper classes, fostered and peer-legitimated from one’s first tax return, it speaks to a deeply ingrained cognitive dissonance; ‘entitlement is bad, but we work hard and earned our money, so we are entitled to keep our own income from the government by all possible means, and, furthermore, we are savvy in our financial affairs, so we can claim whatever government subsidies are available, regardless of the underlying morality, while still being ‘lifters’ rather than ‘leaners’’.

While most visceral during the end of financial year season, this sense of entitlement spans the year through, and extends far beyond filing questionable personal income tax returns.

It goes to the knee-jerk move made by any individual newly wealthy enough to need an accountant; the creation of a ‘family trust’, which allows the avoidance of a certain amount of tax through the distribution of personal income to family members, basically the dole for the families of the rich subsidized by the Australian treasury.

It extends also to those gold standard institutionalised subsidies to the wealthy that form unshakeable pillars of our society; negative gearing and the capital gains tax exemptions to property, which encourage speculation, inflate the Australian property bubble, reduce home ownership, and redistribute wealth into the pockets of the already wealthy at a cost of about $4 billion per year to the Australian public purse, the most prolific subsidy of the affluent by the taxpayer in Australia, with over 1.2 million people taking advantage of it annually.

The phenomenon of Australia’s middle and upper classes sneering down their noses at the disabled, the elderly, and the unemployed, for daring to claim meagre subsistence benefits, while guzzling at the trough of public funds for every possible tax, superannuation, and state supplied financial benefit within snout-reach, is now well established. The practice is undergirded by financial and taxation systems with huge gulfs between what is legal, and what is ethical.

Our good treasurer is the example par excellence of this system in action. While publicly demanding an ‘end to the age of entitlement’, Mr Hockey, who is paid $366,000 dollars a year by the Australian public and owns a property portfolio valued at around $10 million dollars, continued his long standing practice of claiming $270 a night from the taxpayer to stay in his own family home whenever he is in Canberra, a house that has increased in value from $377,000 in 1997 to around $2 million now. Totally legal, and completely unethical.

In Australia, wealth inequality has been gaining steam for decades. We now approach the levels found in the United States and the United Kingdom. The fair go for everyone that was the greatest source of pride in the Australian national identity has disappeared before our eyes.

Australia has gone from The Lucky Country of Donald Horne, where “most people earn within a few pounds of the average”, to a nation that ranks within the top 3 to 4 most unequal countries in the developed world, by metrics of disparity between top 10 per cent and bottom 10 per cent income.

The chronic rise in wealth inequality, the rampant sense of entitlement of Australia’s middle and upper classes, and the inequitable and morally spurious financial regulation and tax legislation in this country act to constantly and mutually reinforce each other.

There is no date in the calendar which better highlights this nexus of privilege, scorn, and entitlement than the 1st of July. Happy New Financial Year.

ROBERT B. REICH, Chancellor’s Professor of Public Policy at the University of California at Berkeley and Senior Fellow at the Blum Center for Developing Economies, was Secretary of Labor in the Clinton administration. Time Magazine named him one of the ten most effective cabinet secretaries of the twentieth century. He has written thirteen books, including the best sellers “Aftershock” and “The Work of Nations.” His latest, “Beyond Outrage,” is now out in paperback. He is also a founding editor of the American Prospect magazine and chairman of Common Cause. His new film, “Inequality for All,” is now available on Netflix, iTunes, DVD, and On Demand.

ROBERT B. REICH, Chancellor’s Professor of Public Policy at the University of California at Berkeley and Senior Fellow at the Blum Center for Developing Economies, was Secretary of Labor in the Clinton administration. Time Magazine named him one of the ten most effective cabinet secretaries of the twentieth century. He has written thirteen books, including the best sellers “Aftershock” and “The Work of Nations.” His latest, “Beyond Outrage,” is now out in paperback. He is also a founding editor of the American Prospect magazine and chairman of Common Cause. His new film, “Inequality for All,” is now available on Netflix, iTunes, DVD, and On Demand.

“Ms Bishop has made several similar statements recently. In a Network Ten interview on February 10, she said: “We can’t solve all the problems of the budget debt and deficit, the massive unprecedented size of it that we inherited from Labor – because it was the worst set of financial accounts inherited by any incoming government in Australia’s history.”

The verdict: Large borrowings to finance Australia’s participation in World War I and World War II and the impact of the Great Depression led to much higher deficits and levels of debt than any government has experienced since. The Howard Government also inherited more gross and net debt and a higher budget deficit relative to GDP than the Abbott Government. Ms Bishop is wrong.

![Anti-austerity: A political revolution It seems that if you give previously disengaged people something to believe in, the connection with politics is instant and inspiring, writes Shabi [AP]](https://i0.wp.com/www.aljazeera.com/mritems/imagecache/mbdresplarge/mritems/Images/2015/8/3/0b74123be398446f9ef8c4106c0b627b_18.jpg)

You must be logged in to post a comment.