Mathias Cormann assures us that we have very strict tax avoidance laws.

These “strict” laws allow 75 individuals who made an average of $2.6 million each in 2011-12 to pay no tax at all – no income tax, no Medicare levy and no Medicare surcharge.

These “strict” laws allow almost a third of Australia’s largest companies to pay less than 10¢ in the dollar in corporate tax.

Ernst & Young is the auditor of Westfield Group, James Hardie and 21st Century Fox, all of which pay less than 1 per cent tax, according to the report, Who Pays for Our Common Wealth, produced by the Tax Justice Network and the union United Voice.

It is also the auditor of some of the US multinational tech companies accused of paying minimal tax in Australia, including Google, Apple, Amazon and Facebook.

Accounts show 21st Century Fox spent $US19 million on tax advice from E&Y in 2013.

The G20 assure us that they are talking about how to cut down on tax avoidance. A deal struck at the G20 summit in Cairns will see authorities in more than 40 countries sharing information — including bank balances and income — to identify companies that avoid tax.

But Australia will not begin swapping the financial details until September 2018, one year after countries including Britain, Germany, India, Ireland, The Netherlands and a handful of tax havens.

Why wait? We make our own laws, we could close the loopholes right now if we wanted to. Instead, we are slashing staff at the Australian Tax Office by so much (4,700 over the next few years) that they will not have the personnel to pursue tax cheats.

“Morale is down and 3000 of our most senior staff have recently taken redundancy package,” said one former officer. “There was also an absurd clear out of senior transfer pricing staff about two years ago, so there is very little likelihood of the ATO ‘manning-up’ on multinationals any time soon. The general impression among senior ATO officers is that we are supposed to give the big firms what they want and to usher the revenue out the door. The News decision (not to appeal the $882 rebate to Rupert) is symptomatic of that and a lot of staff were pissed we caved on that case.”

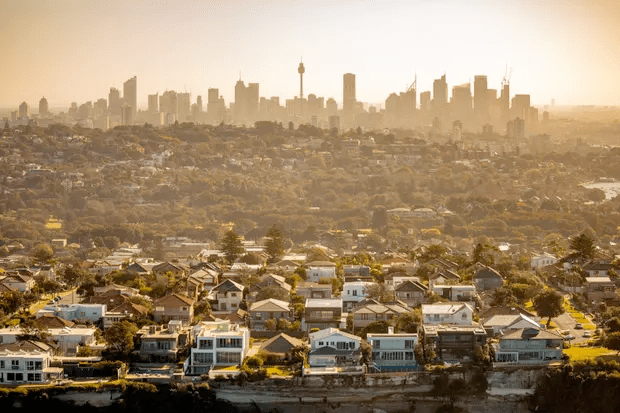

With reports that one in three elderly Australians are living in poverty, despite being among the most highly educated senior citizens in the world, that 17% of our children live in poverty, that making unemployed people under 30 wait six months for income support and raising the eligibility age for the dole to 25 could breach human rights to social services and an adequate standard of living, I would suggest that if Tony Abbott wants to spend hundreds of billions on defence and border security he starts taxing his party donors, beginning with Rupert.

You must be logged in to post a comment.